hotel tax calculator quebec

Avalara automates lodging sales and use tax compliance for your hospitality business. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

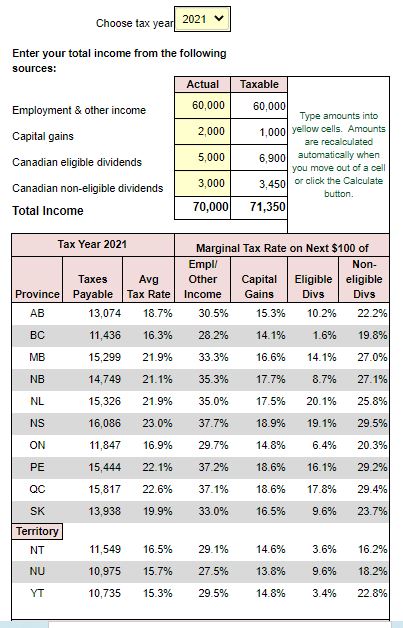

Over 84369 up to 96866.

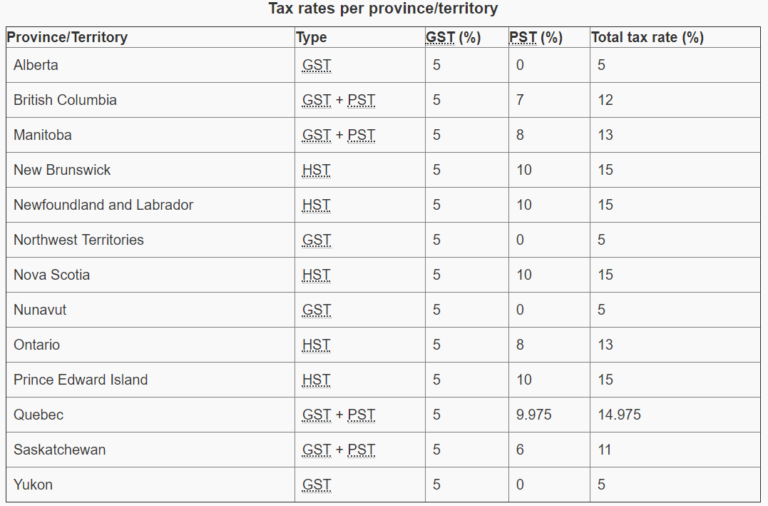

. The following table provides the GST and HST provincial rates since July 1 2010. Plus Tax Amount 000. If you are paying on meals the total tax would be 14975.

Ad Finding hotel tax by state then manually filing is time consuming. The provincial income tax rates in Quebec range from 15 to 2575. The total amount you will pay for a 12 CAD item is 1367.

Before Tax Amount 000. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms. Avalara automates lodging sales and use tax compliance for your hospitality business.

If youre selling an item and want to receive 000 after taxes youll need to sell. Basically 18999125 on hotel rooms. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at.

No additional hotel room taxes in Nunavut. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. Type of supply learn about what.

If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. This means the total tax on the. Over 42184 up to 84369.

Due to an agreement between Quebec. This is any monetary amount. Over 96866 up to 117623.

Some municipalities in Ontario charge additional taxes on. In Quebec the provincial sales tax is called QST Quebec Sales Tax. With the official today valid Taxi Rate Quebec from January 2020.

Minus Tax Amount 000. Ad Finding hotel tax by state then manually filing is time consuming. Formula for calculating the GST and QST Amount before sales tax x GST rate100 GST amount Amount without sales tax x QST rate100 QST amount Amount without sales tax GST.

Income Tax Calculator Quebec 2021. All other hotels with 81-160. Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

Tax billed by the operator of an establishment 35 tax on lodging billed on the price of an overnight stay. The rate you will charge depends on different factors see. So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900.

That means that your net pay will be 36763 per year or 3064 per month. The Quebec Annual Tax Calculator is updated for the 202223 tax year. By day 5400.

Calcul taxes des résidents du Québec au Québec 2022 Vous aimez calcul conversion. Multiply 1260 by 85 percent 085. Le TIP est au moins égal à.

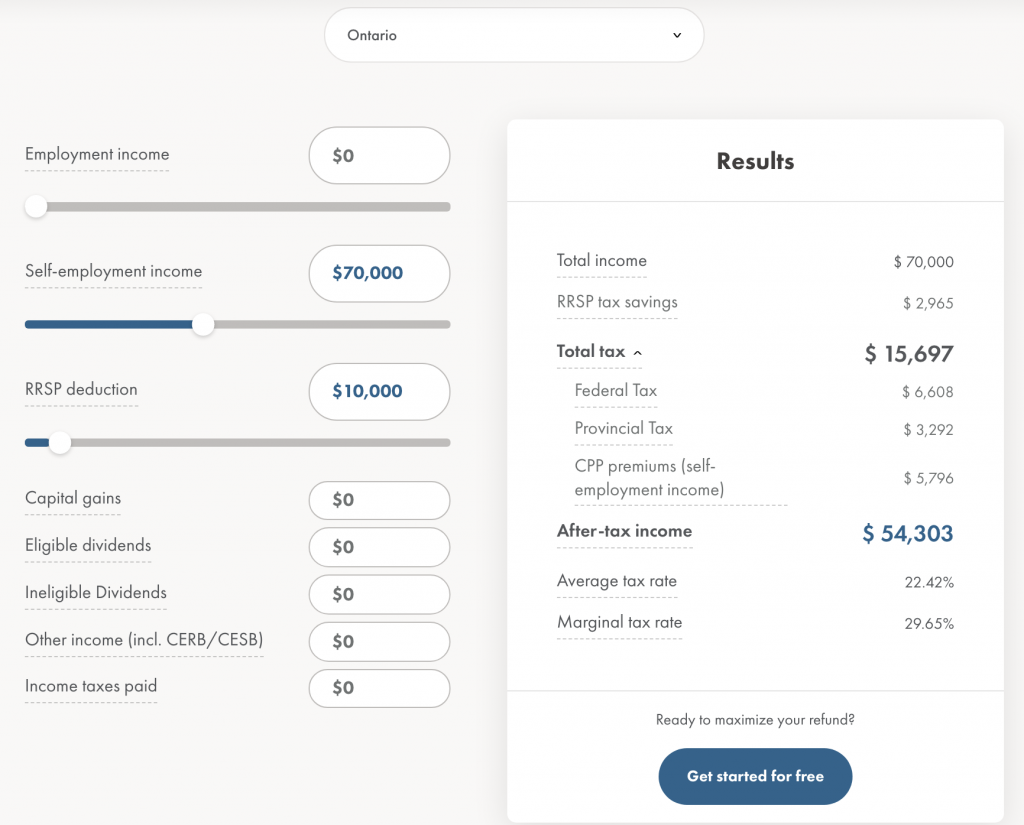

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Recent taxi price calculations in Quebec. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

Add this amount to 1260. The answer is 107. The tax on lodging is calculated only on the price of the overnight stay.

Over 117623 up to. Tweeter Montant avanthors taxes TPS 5 TVQ 9975 Montant avec taxes La nouvelle. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

Quebec tax bracket Quebec tax rate. Calcul taxes TPS et TVQ au Québec. Moderate C100 to C200 Cheap up to C100 These prices are based on the lowest standard rates for a double room excluding taxes and excluding breakfast unless otherwise specified.

For 2021 the non-refundable basic personal amount in Quebec is 15728. The hotel tax is 3 and the GST goods and services tax is 5 as well as TVQ Quebec sales tax which is 74Every Montreal hotel bill contains a 5 tax.

Quebec Sales Tax Calculator And Details 2022 Investomatica

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Quebec Sales Tax Calculator And Details 2022 Investomatica

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Statistics Canada Property Taxes

What Are Sale Tax And Hotel Tax In Montreal Canada Ictsd Org

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Statistics Canada Property Taxes

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Qpp Contribution Calculator Montreal Financial

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips